It is tough for an industry which focuses on risk and worst case scenarios to present itself in any way other than earnest. Its customers need reassurance it will be there in their hour of need. But the way to earn trust and confidence is not through detail and copious amounts of information. It is through transparent, clear and straightforward communication.

The average person doesn’t know much about insurance and doesn’t really know what it is they need but they do know it is important to get the right cover. So the opportunity to win trust and confidence should be enormous.

Unfortunately the insurance sector is plagued, rightly or wrongly, by a perception of hard selling, over selling, too much fine print with too many get out clauses and very little after sales service. It is this perception that the CII’s Aldermanbury Declaration sets out to address and also what professional insurance firms are working against and trying to genuinely dissipate on a daily basis.

The most important thing to earn trust and credibility in any insurance company’s marketing toolkit is straight talking. You may not be able to avoid the fine print and legal detail completely but you can present it in a way that your customers can easily and quickly digest. Removing the mystery and confusion doesn’t make you redundant, it makes you invaluable.

The second most important thing is the after sales follow up. Nothing will lose the loyalty and good will of a customer more quickly than the feeling they have been sweet talked into a sale but become of little value subsequently. It will only serve to reinforce the perception that the industry is trying to dispel.

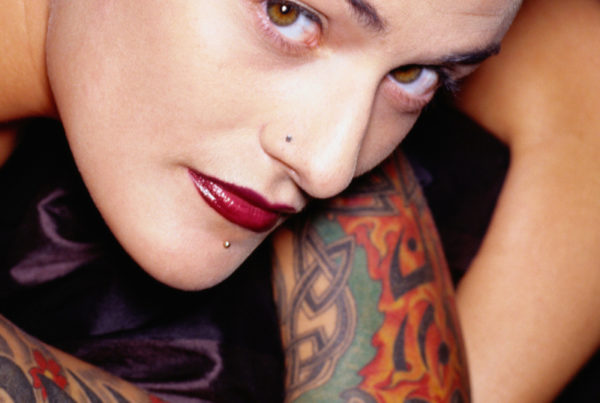

Keeping it simple doesn’t have to equate to average. If you consider some of the most successful and resilient marketing concepts they are often the simplest ones, the ones that are understated, uncomplicated and intelligent. Insurance firms need to look outside their industry to see what else is happening in the wider market; not only to competitors but to other sectors to see what can be learnt in order to break away from the insurance mould and set themselves apart from the crowd.

For a sector which is working towards changing its ‘brand’ via initiatives such as the Aldermanbury Declaration and the general consensus that professional excellence is a standard that should be considered the norm, doing what you have always done is not an option.

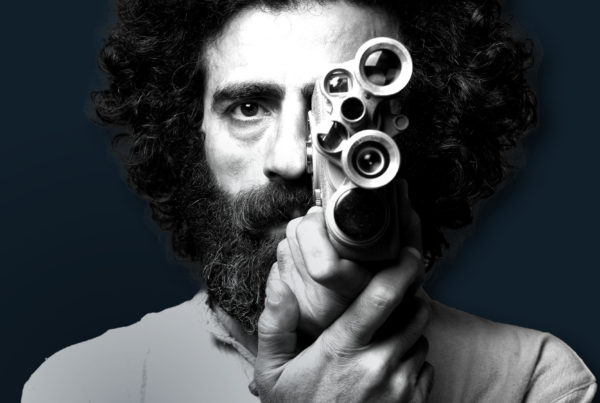

With insurance the devil is in the detail but this doesn’t mean insurance has to be complicated or that it can’t be creative in its approach. It just means daring to be different.